BPCE

product strategy 2018

THE CONTEXT

How do you turn an institutionnalized bank products centric to users centric ?

After 6 months of discovery and analysis of the different contexts linked to their users, we joined 89C3, the digital factory of BPCE, one of the main bank in France, to work on the new version of their app which as to be rebuild from the ground up to be aligned with their users needs.

THE PROPOSAL

Based on the global analytic work done by the team, we defined the product strategy of the main banking app, and approach the overall conception with a common method for all the teams to ease sharing of components and feedbacks, based on a product vision and design principles.

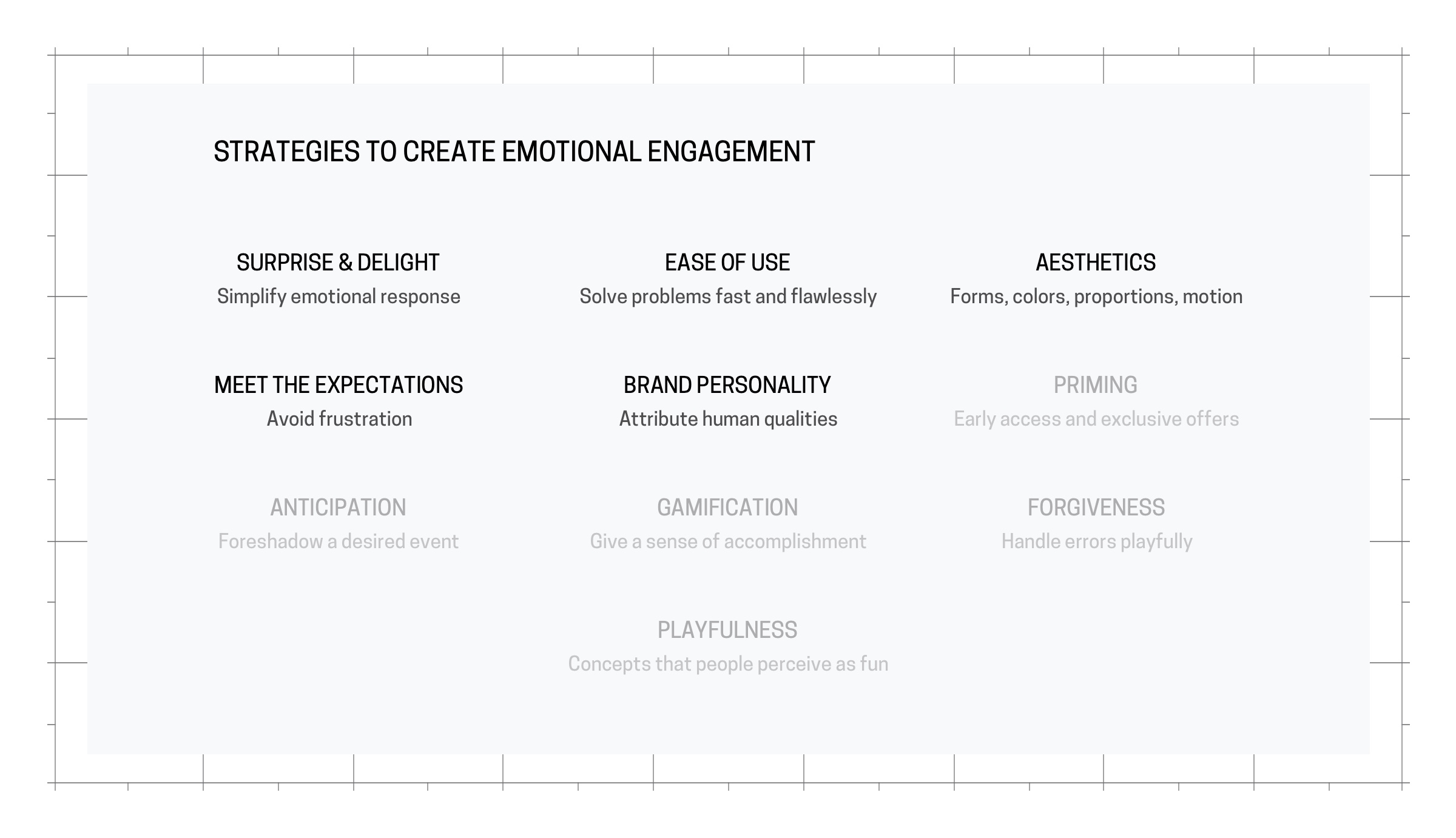

Types of emotional triggers appropriate to use in the sensitive area of personal finances

DEFINE THE VISION

How do you guide a core rebuilt of an existing product without being too feature focus, without ending up with a product that aim to do it all with no hierarchy, without loosing all the users due to an unclear direction ?

By summarizing the group direction, replacing the product into the bank ecosystem and keeping the users needs up on mind.

Vision :

Understand users behaviours to walk our users throught their projects, and give them the ability to understand and act on the financials leverage at their disposal.

As a data-based service, knowing our users by data analysis and research is a healthy foundation to build something relevant.

Last, we are on a long term mission to give people the basics understandments of banking offers and actions to let them choose wisely what kind of credit or saving plan they prefer to choose. It’s not about making them learn the arcane of banking than letting them have more controls on where their money go.

AN EMOTIONNAL EXPERIENCE THROUGHT BANKING

The client wanted to strenghten the bond they have with their bank throught a more emotional experience.

What’s this ?

As people, we tend to understand and experience the world through the connections we build with it. They’ll build up through the time and effort spend on, the expectations you have beforehands and the goals you tend to reach.

Why looking for it for a product ?

We relate more easily on a product if a bond is create on a personnal level. Having a service based on personnal datas, the acceptance of our product will be ease and multiply the use of it in order to be more accurate in our help.

How can it be made ?

For a banking product, the positive emotion can be create in a number of ways : the ease of use to achieve tasks, the amplification of good news or prevailing bad ones to be surprises.

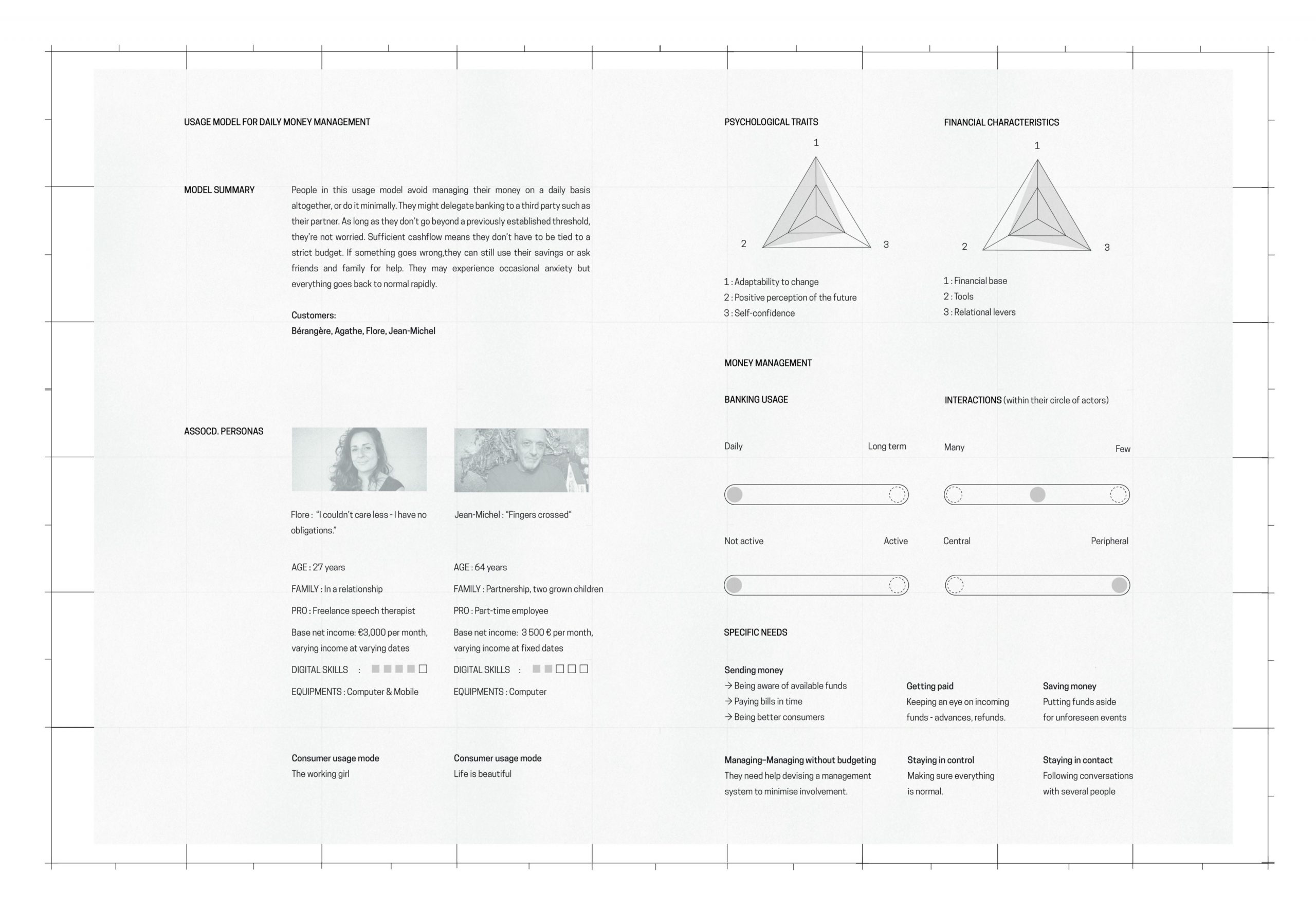

One of the 5 behavioural models made for BPCE

DEFINE THE DESIGN PRINCIPLES

Resulting the product vision and the emotional design strategy, we proposed three design principles to guide the production :

1. Make the user accountable for his expenses to allow him to be autonomous

Tha app have to be as precise as it can be on the accounts states. Always up to date and capable of giving the datas answering one’s question on why, and where a new transaction was made. This to give the user the capability to make thourough decisions on his financial plans to save more.

2. Clarify the bank offers to help the users in their financial management.

By the data generated by the user and the behaviours models we created during the analytics phase, we will push the right products at the right time to the right people.

3. Learn from users behaviours to allow users to anticipate their expanse.

We’re gonna stretch our behaviours models over time to reach a top level accuracy in order to give users transparency on their actual and future finances.